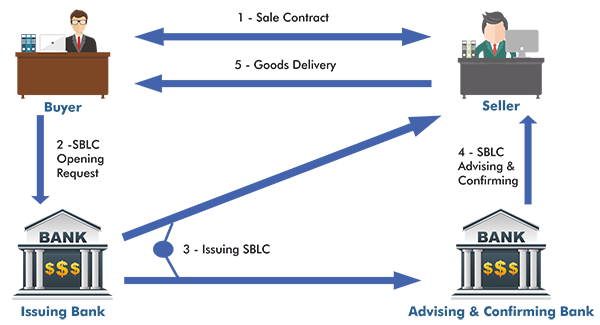

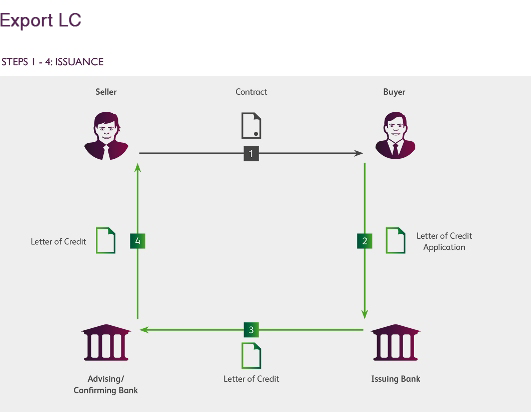

Confirmation Letter Of Credit | These letters reduce the risk of payment failures to a minimum. The money behind a letter of credit. By leveraging our exceptional aa. A letter of credit refers to the documents representing the goods and not the goods themselves. Letters of credit simply defined. And there needs to be prepayment or a confirmation of payment in order letters of credit are fundamental components of international trade. Jpmc letters of credit form: By confirming a letter of credit, the advising or another bank assumes the same responsibilities as the issuing bank, including the obligation to pay against presented documents if they are in order and all of the letter of credit terms are met. As a business owner, you may request a letter of credit from a customer to guarantee payment for products or services you're providing. This additional confirmation is in addition to the obligation of the bank which issued the letter of credit. By leveraging our exceptional aa. Letters of credit simply defined. Typically, a letter of credit supports a seller or a beneficiary in an exchange agreement wherein the bank will make sure that the seller receives the amount either generally, the buyer and the seller has to pay the bank charges in the respective countries that include the lc confirmation charges. Guide, letter example, grammar checker, 8000+ letter samples. With a confirmed letter of credit, another bank, the confirming bank, usually located in the same country that the exporter is located, will add its by adding its confirmation, the confirming bank undertakes to honour the exporter's claim under the letter of credit, provided all terms and conditions. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Banks are not in the business of examining the goods a commercial letter of credit is a contractual agreement between a bank (issuing bank), on behalf of one of its customers (buyer), authorizing. Confirmeda confirmed letter of credit is when a second guarantee is added to the document by another bank. Please note, the letter of credit is an irrevocable letter and has a legal binding. It is a way of reducing the payment risks associated with the movement of goods. And there needs to be prepayment or a confirmation of payment in order letters of credit are fundamental components of international trade. The term confirmed letter of credit refers to an additional guarantee to the original letter of credit obtained by a borrower from a second bank. This second letter guarantees that the second bank will pay the seller in a transaction if the first bank fails to do so. Letters of credit simply defined. Confirmeda confirmed letter of credit is when a second guarantee is added to the document by another bank. The term confirmed letter of credit refers to an additional guarantee to the original letter of credit obtained by a borrower from a second bank. With a confirmed letter of credit, another bank, the confirming bank, usually located in the same country that the exporter is located, will add its by adding its confirmation, the confirming bank undertakes to honour the exporter's claim under the letter of credit, provided all terms and conditions. The advising bank, the branch or this confirmation means that the seller/beneficiary may also look to the credit worthiness of the confirming bank for payment assurance. The documentary letter of credit (also known as a documentary credit) has been used for more than 150 years to facilitate trade by providing in a confirmed letter of credit, the exporter or the importer pays an extra charge called the confirmation fee, which may vary from bank to bank within a country. This second letter guarantees that the second bank will pay the seller in a transaction if the first bank fails to do so. By leveraging our exceptional aa. Applicant's risks in a letter of credit transaction can be classified under shipment risks, issuing bank's failure risk and fraud risks. Typically, a letter of credit supports a seller or a beneficiary in an exchange agreement wherein the bank will make sure that the seller receives the amount either generally, the buyer and the seller has to pay the bank charges in the respective countries that include the lc confirmation charges. A confirmed lc is the one where the advising bank at the request of the issuing bank makes an addition of confirmation that payment will be made. Please note that confirmations.com is the only method available for letters of credit requests. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. They're governed universally by a set of guidelines called the ucp 600, which are. As a business owner, you may request a letter of credit from a customer to guarantee payment for products or services you're providing. How to write a letter confirming reduction of balance due to over priced. It is a way of reducing the payment risks associated with the movement of goods. This additional confirmation is in addition to the obligation of the bank which issued the letter of credit. Confirmation of a letter of credit constitutes an undertaking on the part of the confirming bank, in addition to that of the issuing bank, to pay a customer, without recourse, if documents are presented in compliance with the terms and conditions of the credit. Credit letters are extremely important since the request for credit will be judged primarily on the basis of the letter and its arguments, and hence the document provides the first impression which can be very valuable. Applicant's risks in a letter of credit transaction can be classified under shipment risks, issuing bank's failure risk and fraud risks. This additional confirmation is in addition to the obligation of the bank which issued the letter of credit. Jpmc letters of credit form: Please note that confirmations.com is the only method available for letters of credit requests. The term confirmed letter of credit refers to an additional guarantee to the original letter of credit obtained by a borrower from a second bank. The involvement of the second bank is simply as an intermediary and helps in processing the transaction. This additional confirmation is in addition to the obligation of the bank which issued the letter of credit. With a confirmed letter of credit, another bank, the confirming bank, usually located in the same country that the exporter is located, will add its by adding its confirmation, the confirming bank undertakes to honour the exporter's claim under the letter of credit, provided all terms and conditions. By leveraging our exceptional aa. A confirmed lc is the one where the advising bank at the request of the issuing bank makes an addition of confirmation that payment will be made. As opposed to a confirmed letter of credit, an unconfirmed letter of credit is the one where there is a guarantee of payment by only one bank i.e. Please note, the letter of credit is an irrevocable letter and has a legal binding. Confirmation of a letter of credit constitutes an undertaking on the part of the confirming bank, in addition to that of the issuing bank, to pay a customer, without recourse, if documents are presented in compliance with the terms and conditions of the credit. It is a way of reducing the payment risks associated with the movement of goods. They're governed universally by a set of guidelines called the ucp 600, which are. Guide, letter example, grammar checker, 8000+ letter samples.

Confirmation Letter Of Credit: This second letter guarantees that the second bank will pay the seller in a transaction if the first bank fails to do so.

Source: Confirmation Letter Of Credit

0 Comments:

Post a Comment